Hey Entrepreneurs!

Learn How The Most Profitable Business Owners In The World Use 'Counterintuitive Thinking' To Earn More Money, While Working Less!

Watch My Detailed Video Showing You A Simple Strategy That

DOUBLES The Bottom-Line Profit

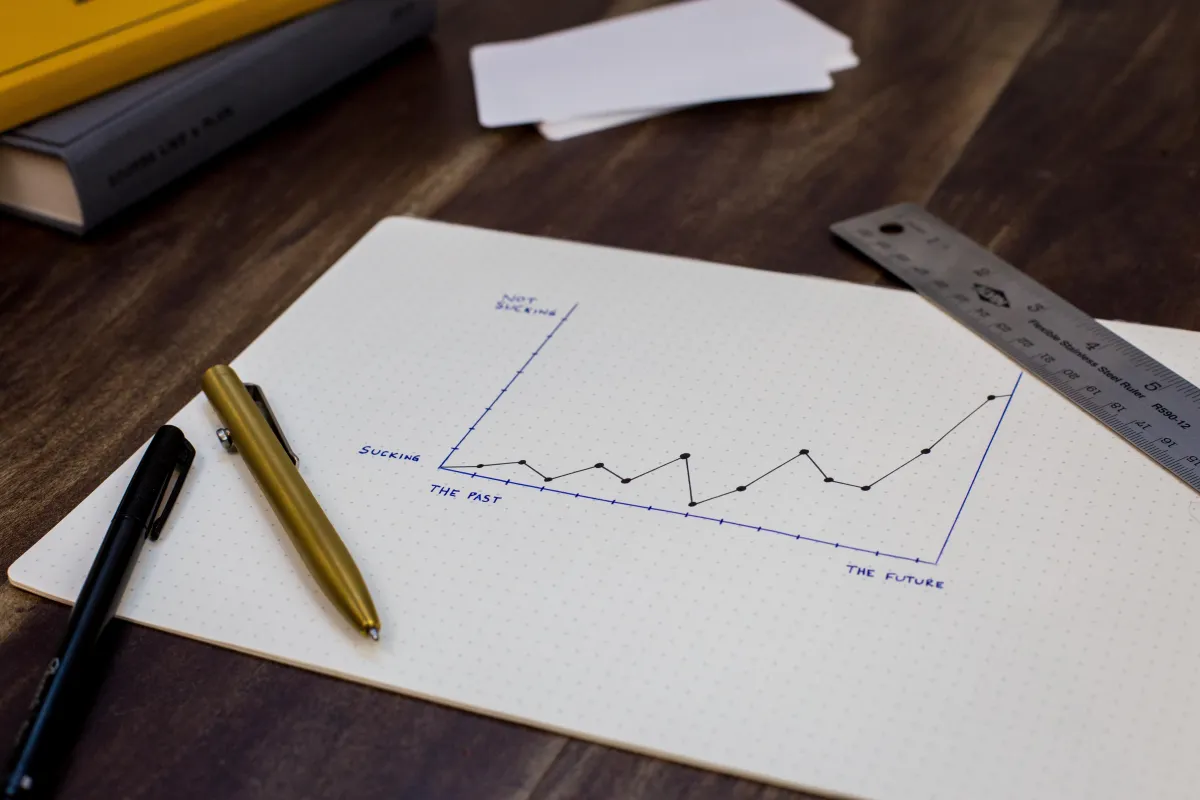

Of ANY Business... Using The Power Of Exponential Growth!

(Hint: Your competitors are NOT aware of this)

And You Can Implement It In A Single Afternoon!

How Does Profit Acceleration Actually Work?

Watch This Brief Video to Find Out!

Why Entrepreneurs Need Business Coaching?

Have you finally made the decision it’s time to get help from a true professional who does this every day… does it successfully… and has a proven track record for making millions of dollars for businesses just like yours?

How Do I Get Started With Business Coaching?

We will assess your business using our revolutionary new Profit Acceleration Software™. We will then detail the specific strategies that can generate massive financial breakthroughs for your business.

At the end of our session I will send you your own customized roadmap for success along with a detailed report that will position your business as the dominant force in your industry.

Do I Have a Track Record of Helping Businesses?

Over the years, I’ve developed a keen understanding of the complex issues facing small business owners in the type of volatile economy we have today. And I know how to get your business or organization noticed among a sea of competitors

Why Are My Prices So Affordable?

Coaching is NEVER an expense. It’s one of the smartest investments any business owner will ever make when it comes to building a successful business.

I will even find my fees BEFORE we start!

Meet Coach Jane Parmel

Jane Parmel

Jane Parmel | Your Profit Growth Partner

Jane Parmel is the go-to expert for small business owners ready to stop struggling and start scaling. As the founder of Cardinal Profit Strategies, she’s spent 30+ years helping entrepreneurs transform cash flow chaos into profit-driven clarity.

Her secret? A proven, personalized system that identifies hidden revenue, slashes waste, and accelerates growth—often without spending a dollar more on marketing. From high-impact Flash Coaching to full-scale strategic planning, Jane delivers real results, fast.

Armed with certifications from Goldman Sachs 10,000 Small Businesses, StartingBloc, and more, Jane is more than a coach—she’s your business’s competitive advantage.

If you're serious about adding $500K+ in revenue over the next 12 months, Jane is the ally you didn’t know you couldn’t afford to miss.

Let’s SOAR—Your Profit Starts Now.

8

PROGRAMS

9

CERTIFICATIONS

30+

YEARS OF EXPERIENCE

101

CLIENTS HELPED

VISIT SOME OF MY

SPEAKING EVENTS!

Learn more about how to attend a FREE Live or Virtual Event. You will walk away from these events with real world tactics and a plan to dramatically increase your profits starting NOW!

I’VE INSPIRED HUNDREDS OF BUSINESSES!

One-On-One Coaching

Looking for professional help that’s affordable? I will help you increase your leads and sales, generate leads, create marketing that actually produces results, increase your revenue substantially, and position your business as the dominant force in your industry.

Group Coaching

My group coaching program will allow you to not only learn new business growth strategies from me, but also other small business owners with the same goals as you have for your own business. We will work on application of these strategies because knowledge is pointless without using it.

DIY Online Learning

Everything a Small Business Owner needs to know to improve profits. Includes access to all business spreadsheets, e-classes, internet marketing videos, sales letters, profitable headlines, proven marketing material strategies, articles, tips and much more

Profit Acceleration Simulator

Success is achieved through small, incremental changes in multiple areas of your business. We've defined 12 areas that generate immediate increases both revenue and profits, without spending a cent on marketing or advertising.

BUSINESS COACHING CLASSES

Small Business

Financial Training

Virtual Business Academy

Both Financial Training

& Virtual Business Academy

Jump Start 12

Quick Training

Small Business

Marketing Media

Group Live Training

With Virtual Academy

Trusted By

I had a chance to work with Jane in the early stages of building my startup. She was patient and took her time walking me through different business development exercises that are now staple practices in my day-to-day operations. She was also very much present and available if I needed advice editing a pitch or masterminding a new marketing campaign; she was always a phone call or email away. Whether you are a new founder or looking to advance within your current career, the knowledge and expertise that Jane provides is invaluable.

Aurelia E.

Jane Parmel, is honest, resourceful and goal oriented. During her time working with my staff, we all admired her mindful approach to details, implementing systems in operations and organization. These skills, along with her fearless sense of humor make her an asset to any professional setting.

Marie K.

THERE'S ALWAYS ROOM FOR GROWTH AND SKY'S THE LIMIT.

Let me help you explore where your limit as an entrepreneur is!

***DISCLAIMER:

The information contained on this Website and the resources available for download through this website is not intended as, and shall not be understood or construed as, professional advice. While the employees and/or owners of the Company are professionals and the information provided on this Website relates to issues within the Company’s area of professionalism, the information contained on this Website is not a substitute for advice from a professional who is aware of the facts and circumstances of your individual situation. Nothing on this site, nor advice from our experts, shall constitute legal advice.

Copyright 2025© Cardinal Profit Strategies | Jane Parmel | Rockaway Park, NY, US